Some Ideas on Virtual Cfo In Vancouver You Should Know

Wiki Article

Vancouver Tax Accounting Company for Beginners

Table of ContentsTax Consultant Vancouver - TruthsEverything about Cfo Company VancouverThe 6-Minute Rule for Vancouver Tax Accounting CompanyThe Best Strategy To Use For Tax Consultant Vancouver9 Easy Facts About Outsourced Cfo Services ExplainedThe 2-Minute Rule for Vancouver Accounting Firm

Right here are some benefits to hiring an accountant over a bookkeeper: An accounting professional can provide you a thorough view of your service's monetary state, along with strategies and also suggestions for making financial decisions. Accountants are just responsible for recording economic purchases. Accountants are needed to finish more education, certifications and also work experience than bookkeepers.

It can be tough to determine the ideal time to work with an accounting expert or bookkeeper or to figure out if you need one at all. While several local business employ an accountant as a specialist, you have numerous options for managing economic tasks. Some tiny company proprietors do their own bookkeeping on software application their accounting professional advises or makes use of, supplying it to the accounting professional on an once a week, month-to-month or quarterly basis for action.

It may take some background study to find an ideal accountant due to the fact that, unlike accounting professionals, they are not required to hold an expert qualification. A strong endorsement from a relied on colleague or years of experience are necessary variables when hiring a bookkeeper. Are you still uncertain if you require to employ somebody to aid with your books? Here are three circumstances that suggest it's time to hire a monetary expert: If your taxes have actually ended up being as well complex to handle on your own, with multiple income streams, international financial investments, a number of deductions or various other considerations, it's time to employ an accounting professional.

See This Report about Pivot Advantage Accounting And Advisory Inc. In Vancouver

For local business, adept money management is an essential aspect of survival and also development, so it's wise to function with a monetary professional from the beginning. If you like to go it alone, take into consideration starting out with bookkeeping software application as well as keeping your publications meticulously approximately day. In this way, should you need to employ an expert down the line, they will have exposure into the complete economic background of your business.

Some resource interviews were carried out for a previous variation of this short article.

Vancouver Accounting Firm Can Be Fun For Everyone

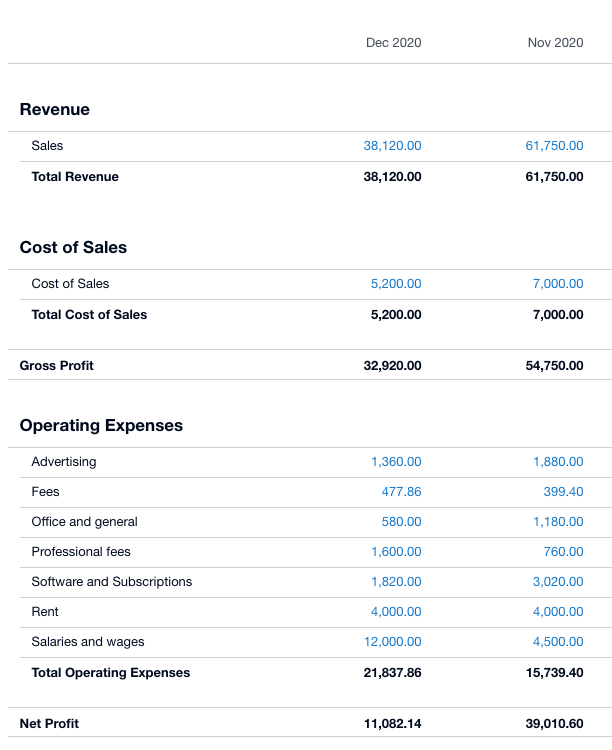

When it involves the ins and outs of taxes, accounting as well as financing, nevertheless, it never ever harms to have a knowledgeable expert to count on for support. An expanding variety of accounting professionals are additionally taking care of points such as cash circulation forecasts, invoicing and also HR. Eventually, much of them are tackling CFO-like roles.When it came to using for Covid-19-related governmental funding, our 2020 State of Small Business Study discovered that 73% of see this page little service owners with an accounting professional stated their accounting professional's advice was very important in the application process. Accounting professionals can additionally aid organization owners stay clear of expensive errors. A Clutch study of small business proprietors programs that even more than one-third of small companies list unexpected costs as their leading monetary difficulty, adhered to by the mixing of organization and personal finances and also the lack of ability to receive settlements on schedule. Small company proprietors can anticipate their accountants to aid with: Choosing business structure that's right for you is very important. It influences just how much you pay in tax obligations, the documentation you need to submit and also your personal obligation. If you're aiming to convert to a various company framework, it could result in tax effects and various other difficulties.

Also companies that are the same dimension and also sector pay very different quantities for audit. Prior to we get right into dollar numbers, let's talk concerning the expenditures that go right into small company accounting. Overhead expenditures are costs you could check here that do not directly become an earnings. These costs do not transform right into cash money, click here to read they are required for running your organization.

4 Easy Facts About Vancouver Tax Accounting Company Explained

The ordinary expense of bookkeeping services for tiny business differs for every unique scenario. Yet considering that accountants do less-involved tasks, their prices are typically cheaper than accountants. Your financial service charge depends on the work you need to be done. The ordinary monthly accounting fees for a small company will rise as you add much more services as well as the jobs get harder.You can videotape purchases and also process payroll using on-line software program. Software application services come in all shapes and also dimensions.

How Outsourced Cfo Services can Save You Time, Stress, and Money.

If you're a new company proprietor, don't neglect to variable audit prices into your budget. Administrative prices and accountant costs aren't the only audit expenses.Your ability to lead employees, serve clients, and choose can suffer. Your time is also beneficial as well as must be considered when checking out audit expenses. The moment invested in audit jobs does not produce revenue. The much less time you spend on bookkeeping and taxes, the even more time you need to grow your service.

This is not planned as lawful advice; for more info, please click below..

The Facts About Vancouver Accounting Firm Revealed

Report this wiki page